A 1099 contractor is a person who works independently rather than for an employer There are significant differences in the legalities of a contractor and employee While the work can be similar in nature, it is important to follow the law with regard to taxes, payments, and the like What Is the Difference Between 1099 and W2?Subcontractor Agreement How to Hire an Employee (7 steps) Step 1 – Make a Job Posting Step 2 – Reviewing Applications Step 3 – Setup Interviews Step 4 – Perform a Background Check Step 5 – Negotiate the Terms Step 6 – Write the Employment Contract Step 7 – The Hiring ProcessDo not designate someone as a 1099 Employee if Company provides training on a certain method of job performance

Canada Independent Contractor Agreement Template Legal Forms And Business Templates Megadox Com

Independent contractor agreement sample pdf

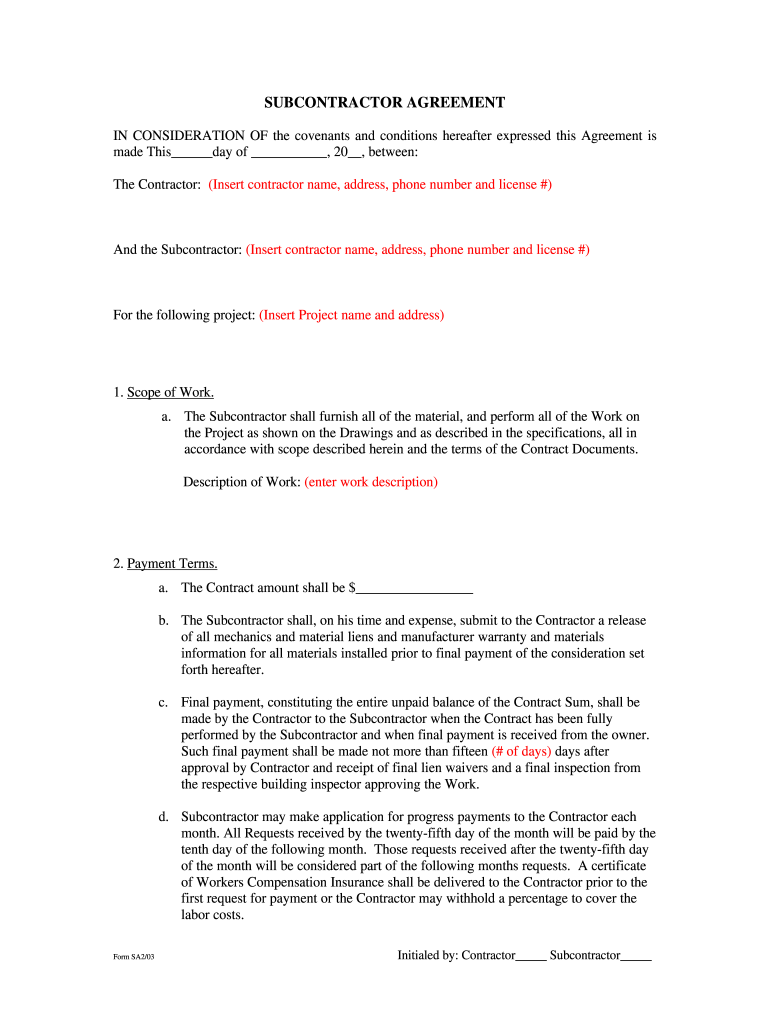

Independent contractor agreement sample pdf-1 Definition CONTRACTOR is responsible for own taxes through a 1099 tax form at the end of every filing year;Standard Short Form Agreement Between Contractor and Subcontractor Page 3 of 6 later than seven (7) days after receipt by Contractor of final payment from Owner for Subcontractor Work These payments are subject to receipt of such lien waivers, affidavits, warranties, guarantees or other documentation required by this Agreement or Contractor

Contractor Agreement Individual Free Template Sample Lawpath

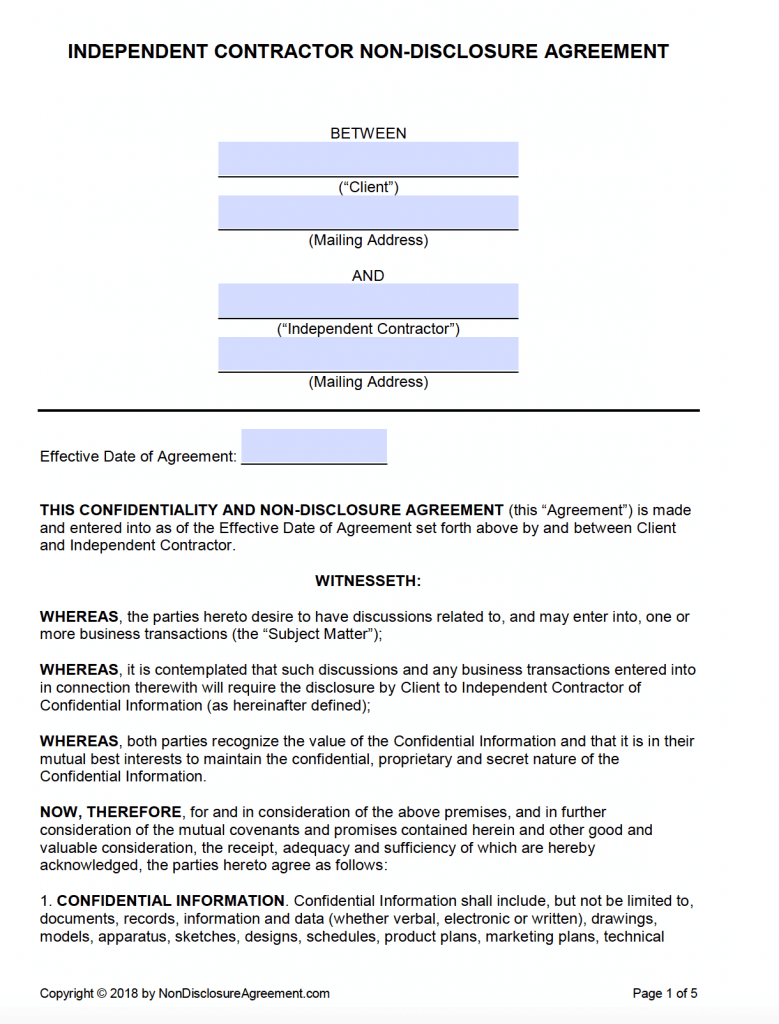

Download the independent contractor invoice template to formally request payment for most any type of independent contracting work This includes freelance home repair, graphic design, writing, and much more Be sure to accurately describe the work you performed and the charges being applied IRS 1099MISC Form – Filed by an independent contractor at the end of the year50 FREE Independent Contractor Agreement Forms & Templates Provided that the relationship and scope of work between them and the company is clearly outlined before the commencement of a project, independent contractors can help a company to save money on employment taxes A great way for independent contractors to outline the relationship andThe parties agree as follows 1 Contractor Services Hiring Party has engaged Contractor to perform the following services _________________________________________________________ (the "Contractor Services") During the performance of Contractor Services, Contractor may be exposed to Confidential Information (as defined below) The Agreement is intended to prevent

As well as your own health benefits, medical expenses, life insurance, and retirement fund CONTRACTOR also acknowledges that CONTRACTOR This needs to be done for every independent contractor to whom you've paid at least $600 for services, and can be done easily with a Form 1099MISC builder Sample Independent Contractor Agreement Use the independent contractor agreement template below to hire freelancers for your business10x Faster Deployment 24/7 Support Team A Single Platform Advanced Analytics

Employers have to produce a W9 to be completed by the independent contractor You may have to file information returns (form 1099MISC) to report certain types of payments made to independent contractors Generally, any payment in excess of $600 will require a 1099MISC Employment Contract Sample Fresh 1099 Contract Agreement Best 5 1099 In 1099 Employee Contract abbykulas Templates No Comments 21 posts related to Employment Contract Sample Fresh 1099 Contract Agreement Best 5 1099 In 1099 Employee ContractGet The Complete Presentation https//landingpageswebsiteleadpagesnet/agilitypresentationtophrissuesof14/Call (619) For More Information

Free Handyman Contract Free To Print Save Download

Contractor Agreement Individual Free Template Sample Lawpath

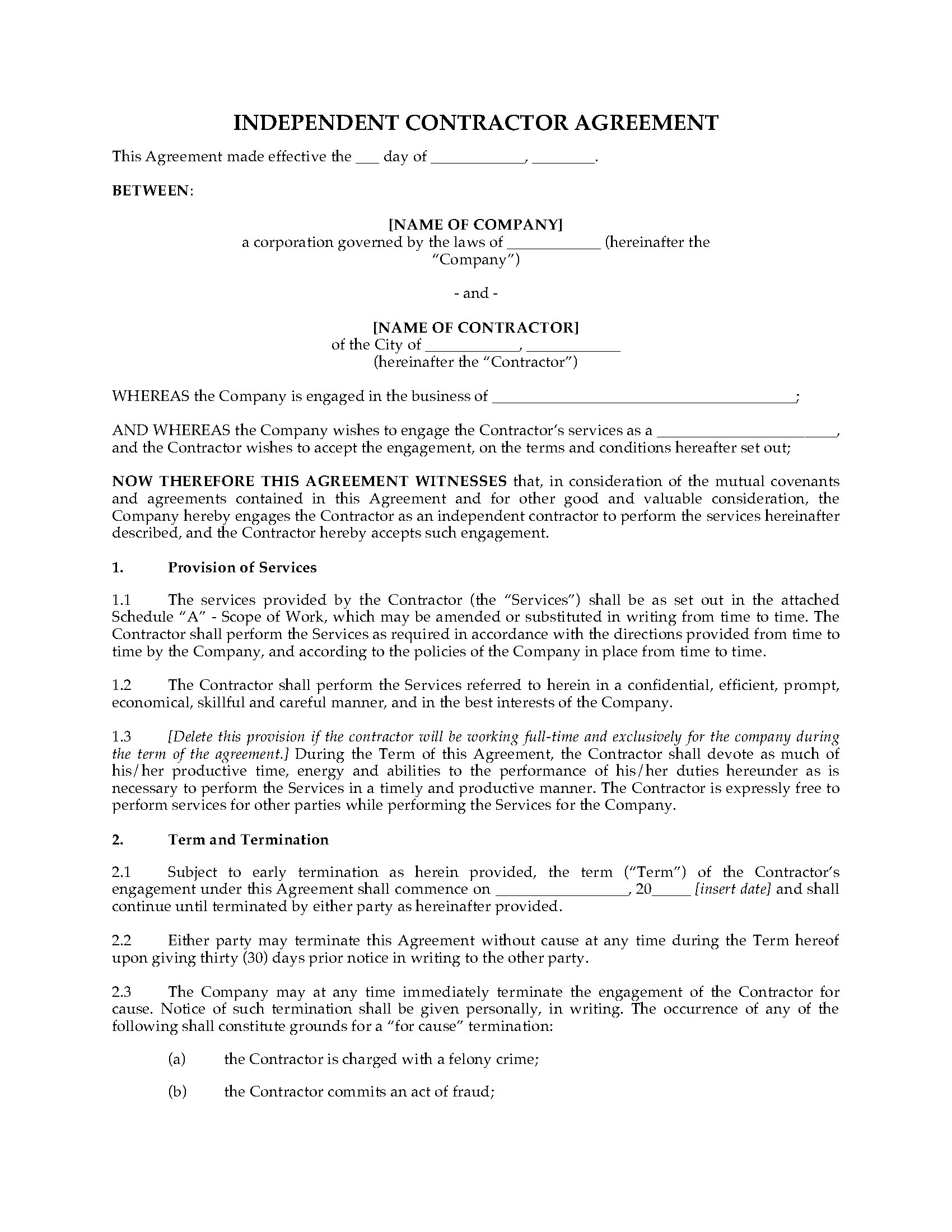

agreement for independent irs form 1099 contracting agreement for independent irs form 1099 contracting services review list this review list is provided to inform you about this document in question and assist you in its preparation 10 free independent contractor agreement templates download 10 free independent contractor agreement templates to help yourself inIRS 1099MISC Form – To be filed by the payor of an independent contractor of any individual that was paid more than $10 in royalties, $600 in payments, or $5,000 of a buyer for resale Contractor Work Order – An outlined request that is made prior to a job being assigned that gives a quote of the costs attributed to the labor and materials associated with the workThe Principal and Independent Contractor hereby agree that during the term of this Agreement and any extensions hereof, this agreement and the employment of the Independent Contractor may be terminated and the Independent Contractor's compensation shall be measured to the date of such termination (i) at will by either party with 90 (ninety) day notice;

30 Simple Independent Contractor Agreements 100 Free

Www Politico Com Pdf Ppm169 Old Freelance Agreement Pdf

Have you paid a person for contract work? When you terminate a sales representative, you need to calculate a final commission report and you must remember to complete the IRS Form 1099 at the end of the year for that salesperson You can create your own nonexclusive sales representative agreement or you can work with an attorney or use a nonexclusive sales agreement template to do so You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting files

Independent Contractor Agreement Template By Business In A Box

50 Free Independent Contractor Agreement Forms Templates

AdFill documents with your data automatically Save time and hassle by eliminating errors Automate multistep workflows with airSlate Bots Generate and prefill documents The independent contractor must also have sufficient time to carefully review the content you have provided in Articles I to XXIV If this document is an accurate representation of the independent contractor`s intentions, he or she should consolidate the agreement by signing the "Contractant`s Signature" line Once the independent contractor is ready, they must recordSample Contractor Safety Agreement Form ehswfuedu Details File Format PDF;

3

Free Printable Independent Contractor Agreement Form Contractor Contract Construction Contract Contract Template

Pandadoccom has been visited by 10K users in the past month Updated A 1099 sales rep agreement is important to have for companies that employ sales representatives It can be the difference between staying open and being forced to shut down the company Employees who only get commissions are called 1099ers due to the 1099MISC form that they receive every year 1099NEC, Copy B — Lists Income You Paid to Contractor – Send to Contractor Sample Forms Filled Out The following sample is created using the instructions from the IRS publication 1099MISC/NEC Instructions Example Contractor Tom Harper subcontracts drywall work to Some Contractor, a sole proprietor who does business

Independent Contractor Agreement Template Proposable

Http Www Aspenparkmetropolitandistrict Org Projects Apmd Cm Landscaping Agreement For Upgrades Construction 16 05 17 Pdf

Did you report the payments made to the IRS?This sample agreement template is signed between a sample contractor and a company, hence it should also include some provisions to cover any local law if applicable Both parties are governed with all terms and conditions such as term and termination of services, contractor services, Ownership and Liability, Confidential Information and other Miscellaneous ProvisionsPopular Form 1099R Versions & Alternatives Form 1099A Online 1099A is a tax document that reports the annual gross proceeds from a business or from a sale of a property 1099A is used for both business and other income For example, if a person rents out a property, they may be required to submit a 1099A for that income

Independent Contractor Agreement Agreement For Consulting Services

2

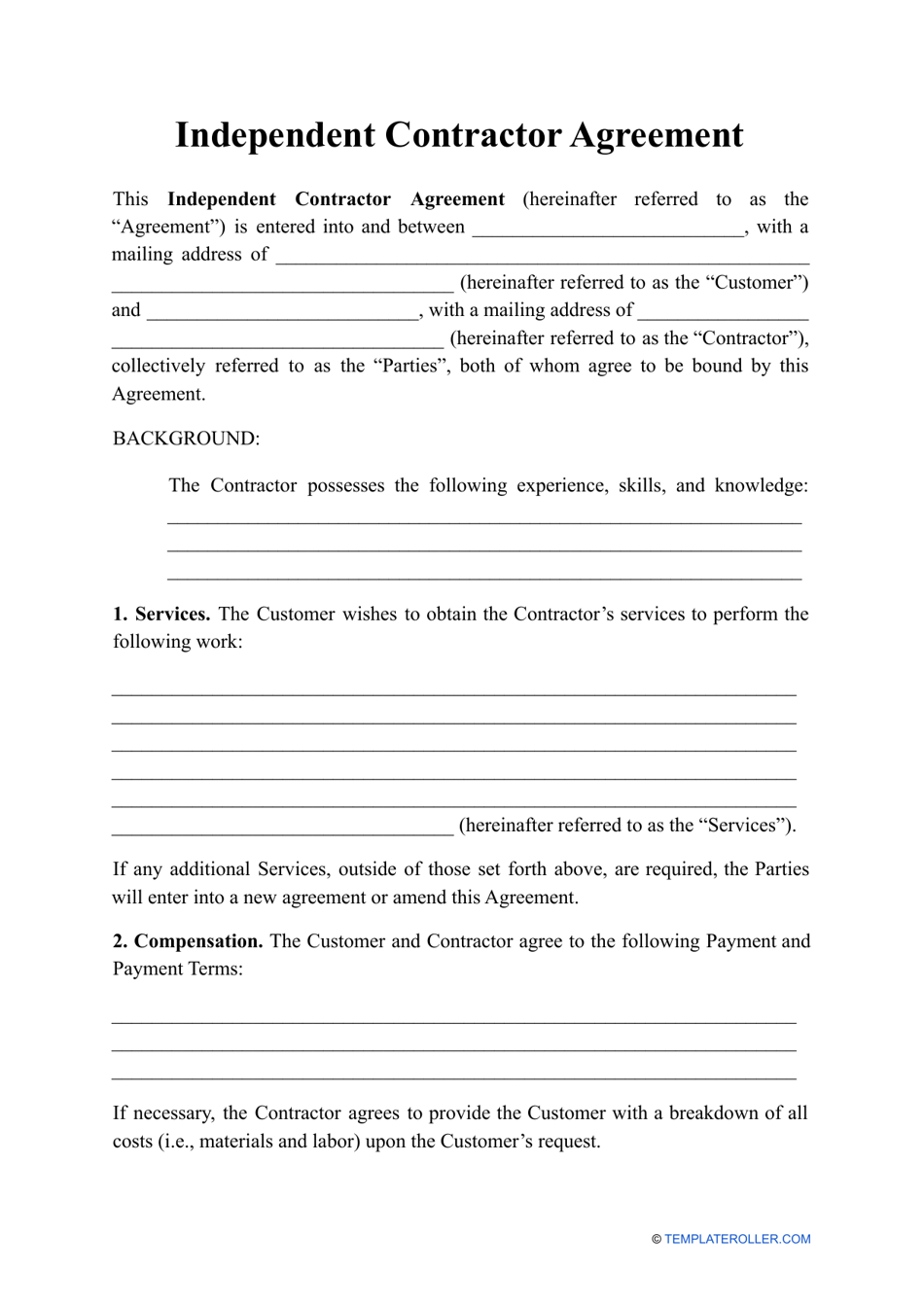

1099 Agreement Template Free Of Independent Contractor Agreement Template Sample free independent contractor agreement template & what to avoid an independent contractor agreement is a legal document between a business and an independent contractor that outlines the details of the work to be performed terms of the agreement deliverables pensation and any additional clauses free template and instructions provided free independent contractor agreement templateContractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employees In its capacity as an independent contractor, Contractor agrees and represents, and Client agrees, as follows Check all that applyUsing an independent contractor agreement template will save you time over creating an agreement from scratch If you hire an independent contractor, you will be required to fill out a Form 1099NEC if you pay them more than $600 within a year The 1099NEC is needed to report how much income an independent contractor earns in a year

Subcontractor Agreement Construction Fill Online Printable Fillable Blank Pdffiller

Http Www Paulhanson Com Forms Contractor Pdf

Payer is reporting on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code You may also have a filing requirement See the Instructions for Form 38 Amounts shown may be subject to selfemployment (SE) tax Individuals should see the Instructions for Schedule SE (Form 1040) Corporations, Spreadsheet or 1099 Excel Template Spreadsheets are a great way to track both your income and your expenses as an independent contractor To get started, create four columns They should be labeled item, cost, date, and then receipt You can make notes about where the receipt is located (maybe an email folder or a physical file)This AGREEMENT made and entered into by and between Mach4Marketing, having an address of Dayton Ln, Temecula, CA (hereinafter "COMPANY"), and ____________________________, having an address of ______________________________________ (hereinafter "CONTRACTOR")

Free Independent Contractor Agreement For Download

Free Independent Contractor Agreement Template For 21 Bonsai

1099 CONTRACTOR AGREEMENT AGREEMENT made as of _________________, between Eastmark Consulting, Inc, a MassachusettsCorporation with its principal office at 44 School Street, Boston, MA ("Eastmark"), and_________________("Contractor"), Federal Identification (or Social Security) ___________________An independent contractor will be responsible for the payment of his own taxes, won't be eligible for any state or federal insurance, and is, most often, paid on a projecttoproject basis rather than on a recurring basis An independent contractor agreement, for tax purposes, is also known as a '1099' agreement Use a 1099 spreadsheet template (Excel or google sheets) Perhaps the best way to track your income and business expense as an independent contractor is through spreadsheets Furthermore, it is beneficial while filling out 1099misc forms Open either Excel or Google Sheets to begin the expense tracking process

Hair Salon Barbershop Independent Contractor Agreement Breach Of Contract Damages

Independent Contractor Agreement Free Contractor Templates 360 Legal Forms

AdAchieve 28% Increase in Close Rate and Reduce Admin Work by 65% with PandaDoc More Integrations, Better Security & Faster Document Creation Try a Demo TodayForm 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or tradeThe Internal Revenue Service requires you to prepare a 1099 Form for a contract worker If you paid the individual person $600 or more during the fiscal year as rent, compensation for performing work, interest, then you need to issue the required 1099 Form

50 Free Independent Contractor Agreement Forms Templates

Usa Independent Contractor Agreement Template Legal Forms And Business Templates Megadox Com

The contractor's required provision of a 1099 form at year's end for the subcontractor's tax filing purposes Selfemployment tax payments being the responsibility of the subcontractor The absence of any promise to pay for profit sharing, pension, paid holidays, paid vacations, insurance, unemployment compensation or any other employment benefitsSize 86 KB Download Prior to taking up a particular task or service, a contractor safety agreement form also needs to be defined with accurate information so that in the case of any injury or mishap, the contractor and the company can face and act in theAn independent contractor may need to file a 1099MISC form with the IRS to report freelance earnings A company employing independent contractors, will need to complete a 1099MISC form if payments to individual contractors reach a threshold set by the IRS

Free Printable Independent Contractor Agreement Form Real Estate Forms Independent Contractor Word Template

50 Free Independent Contractor Agreement Forms Templates

1099 Form is used by employers to report to the IRS how much they paid to its employees There are about a dozen different types of 1099MISC 19, but the most common for an individual 1099MISC form is issued for all miscellaneous income paid to an individual Documents are issued when some company has paid the individual any income other than wagesAdAchieve 28% Increase in Close Rate and Reduce Admin Work by 65% with PandaDoc More Integrations, Better Security & Faster Document Creation Try a Demo TodayThe contract signed between a contractor and their client is known as an Independent Contractor Agreement This legal document is designed to outline the core elements of the transaction between the hiring client and the contractor An Independent Contractor Agreement can also be known as a Freelance Contract Consulting Agreement

Free Independent Contractor Agreement For Download

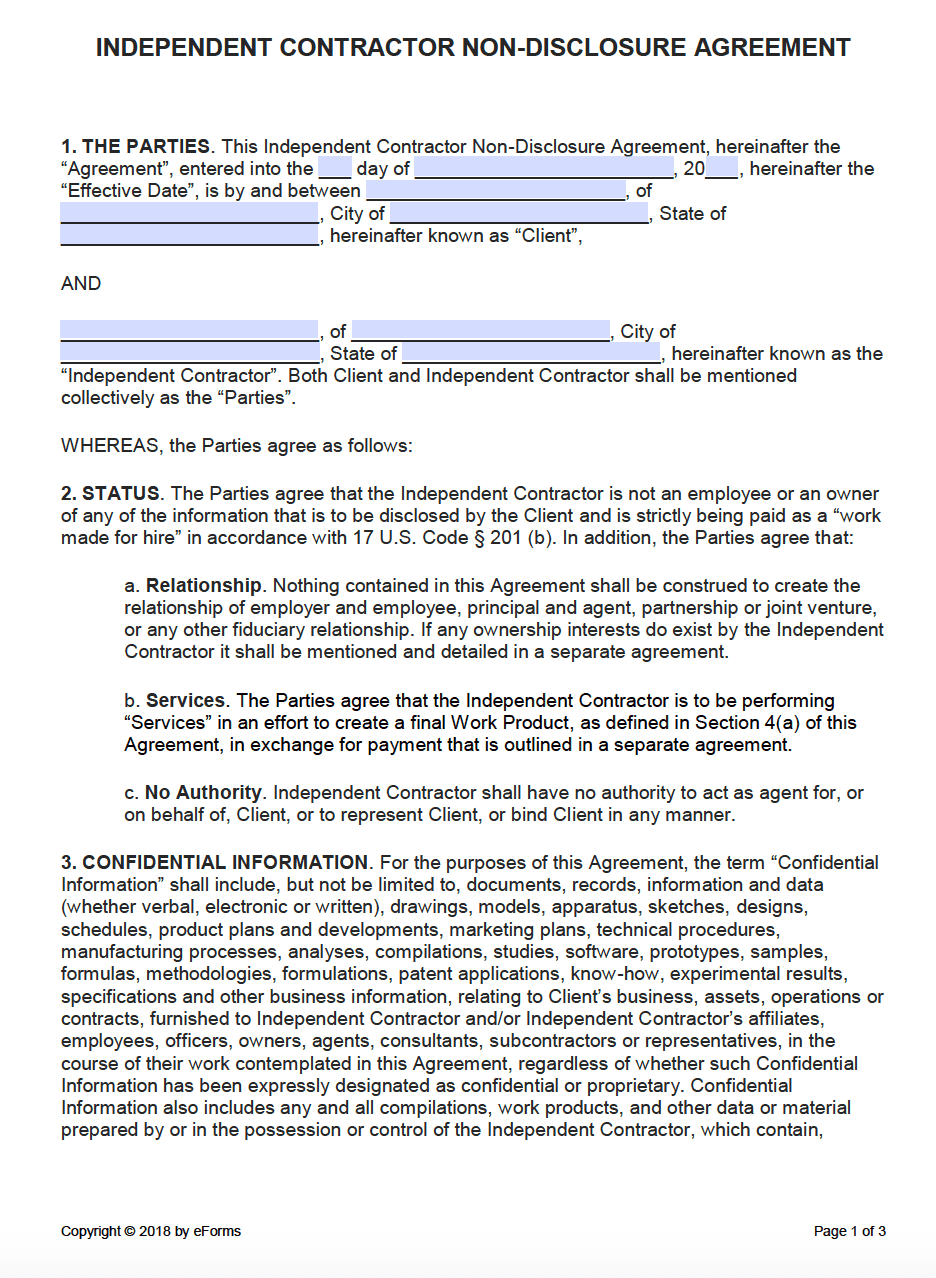

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting filesDownload free template & sample Free doc (Word) and pdf independent contractor agreement template suitable for any industry and essential when hiring new employees for your business Independent Contractor Agreement is a written contract that outline the terms of the working arrangement between a contractor and client, including a description of the services provided,An independent contractor is not considered an employee for Form I9 purposes and does not need to complete Form I9 What are the rules for a 1099 employee?

Free Physician Services Agreement Free To Print Save Download

Free Printable Independent Contractor Agreement Simple Form Generic

This course shows you how airSlate automates the student registration process byThis Agreement also may be terminated at any time upon the mutual written agreement of the Company and Contractor 42 Death In the event Contractor dies during the term of this Agreement, this Agreement shall terminate, and the Company shall pay to Contractor's estate the salary which would otherwise be payable to ContractorIt may be terminated by the Corporation with cause – defined as (1) the failure of the Contractor to act in furtherance of the interests of the Corporation and its clients, (2) a material violation by the Contractor of any provision of this Agreement, (3) the conviction of the Contractor of a crime, or (4) an act or omission which in the sole opinion of the Corporation evidences moral turpitude

Free Independent Contractor Agreement Templates Word Pdf

6 Independent Contractor Agreement Templates Free Printable Word Pdf Free Agreement Templates

3 Length of Term This Agreement will begin on the Effective Date and end_____ , subject to the following _____ 4 Contractor's Representations and Warranties Contractor represents and warrants to Ministry that a Contractor has the skill, experience, and qualifications to perform the Services, and shall perform the Services in aIf required by the Contractor, a Performance Bond and a Payment Bond in a form satisfactory to the Contractor shall be furnished in the full amount of this Agreement These bonds will be furnished by an insurance company on the list of Acceptable Sureties by the Department of the Treasury within the limits stated thereon 9 CHANGE ORDERS

Www Nocccd Edu Files Independent Contract Agreement Revised Pdf

Www Theharriscenter Org Portals 0 Current solicitation documents Contracts and real estate Sample contract inpatient pyschiatric beds jail diversion 18 Pdf

Independent Contractor Agreement Template Download Printable Pdf Templateroller

Free Independent Contractor Agreement Template Download Wise

Simple Contract Agreement Templates Contract Agreement Forms Project Management Small Business Guide

Newportbeachca Gov Home Showdocument Id

Independent Contractor Contract Template The Contract Shop

Truck Driver Independent Contractor Agreement New Truck Driver Contract Agreement Template 21 Awesome Trucking Pany Models Form Ideas

Independent Contractor Agreement Creative Contracts

Http Www Coloradoanesthesiaservices Com Images Fulltime Pdf

Independent Contractor Agreement Bestdox

Independent Contractor Agreement Template Contract Agreement Contractor Contract Nomad Legal

Independent Contractor Contract Template Fill Online Printable Fillable Blank Pdffiller

Free Independent Contractor Non Compete Agreement Pdf Word

Erd Dli Mt Gov Docs Work Comp Regs Sample Memo Of Understanding Pdf

Independent Contractor Agreement For Programming Services Template By Business In A Box

Canada Independent Contractor Agreement Template Legal Forms And Business Templates Megadox Com

Consulting Agreement Template Download Printable Pdf Templateroller

Hmsa Com Portal Provider Sample Quest Integration Agreement Independent Contractor Pdf

Free 5 Bartender Contract Forms In Pdf Ms Word

2

Blank Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

Www Summitcountyco Gov Documentcenter View 3 Independent Contractor Agreement Landfill Final

Exh10 1 Htm

Contractor Agreement Individual Free Template Sample Lawpath

3

Free Minnesota Independent Contractor Agreement Word Pdf Eforms

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Contract Template Awb Firm

Http Www Theincometaxschool Com Wp Content Uploads 12 06 Its Contract Instructor Agreement Pdf

Free Independent Contractor Agreement Pdf Word

Newportbeachca Gov Home Showdocument Id

Independent Contractor Agreement Template Foundd Legal

Free Florida Independent Contractor Agreement Pdf Word

Independent Contractor Contract Sample Free Printable Documents Contractor Contract Contract Template Independent Contractor

Free Digital Marketing Contract For 21 Pdf Template Bonsai

Www Legalzoom Com Download Pdf Independent Contractor Agreement Pdf

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

Letter Of Agreement Independent Contractor For Service Templates At Allbusinesstemplates Com

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Free Independent Contractor Agreement For Download

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Commission Agreement Online Business Templates At Allbusinesstemplates Com

Www Hws Edu Offices Pdf Independent Contractor Agreement2 Pdf

Www Mendocinocounty Org Home Showdocument Id 1950

Contractor Agreement Form 8 Free Templates In Pdf Word Excel Download

In Nau Edu Wp Content Uploads Sites 2 18 06 Independent Contractor Agreement Ek Pdf

50 Free Independent Contractor Agreement Forms Templates

50 Free Independent Contractor Agreement Forms Templates

Agreement Between Owner And Contractor Template By Business In A Box

Sample Independent Contractor Non Compete Agreement Word Pdf

Pin On Agreement Template

Freelance Contract Template Free Download Wise

Usa Independent Contractor Agreement For Real Estate Salesperson Legal Forms And Business Templates Megadox Com

Independent Contractor Agreement Template Contract The Legal Paige

Independent Contractor Agreement Programming Templates At Allbusinesstemplates Com

Real Estate Salesman Independent Contractor Agreement Template By Business In A Box

Sample Independent Contractor Agreement

Free Independent Contractor Agreement Templates Pdf Word Eforms

Www Brotherhoodmutual Com Resources Safety Library Risk Management Forms Independent Contractor Sample Agreement

Independent Contractor Agreement Template Easy Legal Templates

Newportbeachca Gov Home Showdocument Id

Independent Contractor Agreement Creative Contracts

Independent Contractor Contract Sample Free Printable Documents Contractor Contract Independent Contractor Construction Contract

Independent Contractor Agreement California Brilliant Contractor Agreement Template Free Contract Uk With Sales Plus Models Form Ideas

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

Free Freelance Writer Contract Free To Print Save Download

Prima Independent Contractor Agreement

Independent Contractor Agreement Business Taxuni

Contract Forms Free Printable Documents Contract Contractor Contract Independent Contractor

3

3

Independent Contractor Agreement The Association Of Fitness Studios

Free Independent Contractor Non Disclosure Agreement Nda Template Pdf Word

Agreement Non Compete Release Form Former Employer Texas Sample Florida Salon Example

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

0 件のコメント:

コメントを投稿